Payslip Format in Word Free Download

Sample payslip format in Word document is available for free download for offices, factories, mills, and production units. This Pay slip is also available in excel format and is known as a wage slip for salary payments. Please visit the payslip in Excel, or salary slip format for more options.

Sample Payslip Template

| SemiOffice.Com | |||

| Salary Slip for the Month of ____ | |||

| Name: Rosey Urooj | Gross Salary: 15K | Net Salary: 15K | Designation: Mngr |

| Processing Month: 04-13 | Working Days: 30 | Absence: 1 | Leaves: 0 |

| Earnings | Deduction | ||

| Description | Amount | Description | Amount |

| Basic Salary | 11000 | Income Tax | 69 |

| Allowance | 3570 | Van Fare | 600 |

| Arrears | 290 | Security | 150 |

| Others | 0 | Others | 54 |

| Total Earning | 14860 | Total Deduction | 873 |

| Net Payment: | 13987 | ||

| Payee’s Signature ___ | |||

| Accounts Officer | Finance Secretary | Chief Executive | |

Download Sample Payslip format in MS Word from the below link

Details of Payslip: Above Available payslip Format for download includes basic salary, allowance, arrears, Income Tax, Van Fare, security deposit, and deductions section. The word format of the payslip is simple with manual calculations. The first row of the payslip includes gross salary, net salary, working days, leaves, and absents for a particular month.

Usage Instructions

Please download the attached Ms. Word file for a sample pay slip. If the attachment is not showing don’t worry just copy, and paste the above format in Ms. Word file, and make adjustments. Change all the desired information(personal information, salary breakups, payee signature, net payment, etc), and your payslip will be ready to be used, and get it printed on plain paper with authorized signatures.

Purpose of Payslip

It is the most widely used document issued by employers, and companies, and required by the employees, and staff members as a certificate that they have worked with the employer, and have earned the paid amount with the following allowances, and tax deductions.

Download Links:

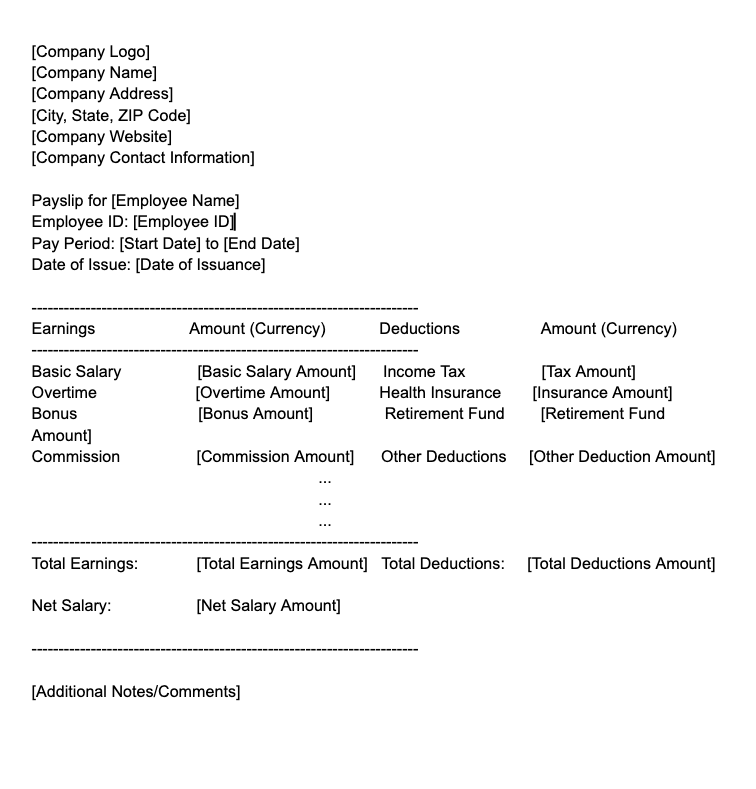

Here’s a simple payslip format that includes the essential elements typically found in a standard payslip:

Copy and paste into a Word file: Download Link: Click Here

- Company Information: This section contains the company’s logo, name, address, website, and contact information for reference.

- Employee Details: The payslip should include the employee’s name and employee ID for identification purposes. It should also mention the pay period, which indicates the time frame for which the salary is being calculated (e.g., weekly, bi-weekly, monthly).

- Earnings: This section lists various components of the employee’s earnings, such as the basic salary, overtime pay, bonuses, commissions, or any other allowances. Each component is accompanied by its respective amount in the local currency.

- Deductions: Here, the payslip displays different types of deductions from the employee’s earnings, such as income tax, health insurance premiums, retirement fund contributions, and any other authorized deductions. Each deduction is listed along with its corresponding amount in the local currency.

- Total Earnings and Deductions: The payslip provides the total earnings and total deductions for the specified pay period.

- Net Salary: This is the final amount that the employee will receive as their take-home pay after deducting the total deductions from the total earnings.

- Additional Notes/Comments: Optionally, you may include any additional notes or comments for the employee’s reference, such as leave balances or other relevant information.

- Download Link: Click Here

Please note that the format may vary slightly depending on the country’s regulations, company policies, and specific components of the payslip. Always ensure that the payslip complies with local labor laws and regulations.